by Jamie Smith, Senior Manager at Harnham, UK.

by Jamie Smith, Senior Manager at Harnham, UK.

At a glance

The Northern data and tech market is entering a new stage of maturity. Demand remains strong, but priorities are shifting from building capability to deploying it.

According to Harnham’s Northern Data & Tech Market Update (Sept 2025), organisations across the region are now competing for professionals who can deliver value at speed.

This regional shift reflects a wider national trend. The UK’s AI sector grew rapidly in 2024, with revenues rising 68 % to £23.9 billion and AI-related employment increasing 33 % to 86,000 roles. These numbers reflect how AI and data capability are no longer future plans but active economic drivers. (Source: Gov.UK)

Over the following sections, we map where demand is strongest, what’s driving it, and how leading employers and skilled professionals in the North are adapting.

1. What’s Changing in the Northern Market

The Northern data market is shifting from experimentation to execution.

AI integration has moved from pilot projects to production, and cloud modernisation remains the backbone of transformation.

Harnham’s Northern Data & Tech Market Update reveals employers now prioritise hybrid profiles: data engineers fluent in cloud migration, analysts driving CRM personalisation, and data scientists capable of deploying models into production.

For employers, this means competition has moved upstream; two-stage processes are filling roles faster, and flexibility is becoming a key differentiator alongside salary.

For candidates, opportunity lies where technical skill meets delivery readiness: the ability to build, test, and operationalise insight at speed. Professionals who can connect data to business value are the ones commanding top-tier packages and long-term career security.

2. Cloud Stack by Company Size

Harnham’s market analysis shows a clear pattern in cloud adoption across Northern firms:

- Large enterprises → GCP. Favoured for data-heavy, AI/ML-driven projects leveraging BigQuery and Vertex AI.

- Mid-sized businesses → Azure. Chosen for legacy migration and integration with existing Microsoft ecosystems.

- Smaller companies → AWS. Still the most popular for flexibility, scalability, and cost efficiency.

This split is shaping demand for data engineers experienced in migration and multi-cloud environments, particularly those who can maintain compliance and governance standards during rapid change.

3. CRM & Customer Analytics

CRM hiring is one of the fastest-growing areas in the North, especially across hospitality, retail, and financial services.

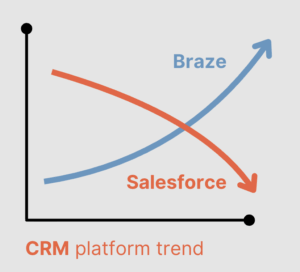

Harnham data shows a strong shift towards Braze, a platform overtaking Salesforce in new implementations due to lower cost and stronger engagement tools.

Harnham’s recent placements of Braze-focused CRM Managers in Staffordshire and Leicestershire point to a broader shift toward agile, campaign-led stacks. Alongside platform expertise, employers now prioritise SQL/Python, campaign analytics, and MMM/attribution to tie spend to outcomes.

4. AI’s Impact on Hiring: Software Meets Science

This shift towards production-ready AI talent is redefining the balance between data science and engineering teams.

Across the North, companies now want engineers who can deploy, not just develop. Skills in Kubernetes, containerisation, and CI/CD pipelines have become core to getting models from lab to live.

The most valuable hires blend software architecture and applied ML, bridging the traditional gap between engineering and data science. Employers increasingly expect data scientists to own deployment and pipeline management, a capability now commanding £100k+ salaries.

5. Spotlight: The North East’s AI Growth Zone

The North East is fast becoming one of the UK’s most dynamic AI hubs. The forthcoming AI Growth Zone is set to create 5,000 new jobs and attract £30 billion in investment, connecting universities, AI firms, and government initiatives in a single innovation corridor.

For employers, it’s a chance to establish a presence in a region gaining national visibility for AI capability. For data professionals, it opens doors to applied research, product development, and start-up collaboration, all without relocating south.

Harnham’s analysis suggests this momentum will sustain demand over the next two years for AI engineers, MLOps specialists, and data governance experts as the region scales.

6. What’s Working in Hiring

Harnham’s Northern Data & Tech Market Update (Sept 2025) highlights three factors separating fast-moving employers from those losing ground:

- Flexibility attracts talent

Around one-third of Northern employers now offer four-day or compressed-week structures. Once experimental, these are now proven differentiators in both attraction and retention. - Speed secures hires

Companies using two-stage interview processes achieve a 30% higher fill rate than those running three or more rounds. - Clarity closes offers

Demand for cross-functional data talent is rising, and employers who combine clear technical assessment with a fast, structured process are filling roles first.

7. What’s Next for Northern Data Hiring

The Northern market’s evolution reflects a wider UK trend: AI maturity now depends as much on people as on platforms.

For hiring leaders, that means focusing on speed, structure, and substance. Building recruitment processes that are efficient, transparent, and centred on long-term capability. Flexibility and learning culture are also fast becoming the deciding factors in attracting top data talent.

For professionals, adaptability is the new edge. Expanding skills in deployment, cloud, and communication will be key to thriving as AI becomes embedded in every data role.

As the global leader in Data & Analytics recruitment, Harnham continues to help organisations across the North build future-ready teams and to support professionals shaping the next chapter of data and AI.

Explore current roles and insights at harnham.com.