Although we think of AI as something groundbreaking, AI’s role in the banking industry, as well as in financial services has been transformative since its inception. The implementation of AI’s banking applications and software solutions has significantly revolutionised the way companies access and manage their finances. It reduces costs, increases productivity, and aids in decision-making based on information that would otherwise be incomprehensible to any human being. Not only that, intelligent algorithms are capable of detecting fraudulent information in a matter of seconds, making AI’s role in banking essential in the fight against fraud.

However, while the advantages of AI in banking must be utlised, banks, investment firms and financial institutions in the EU must also champion boardroom responsibility and their legal obligations to protecting clients when using AI, according to the EU securities watchdog in its first statement on AI.

The European Securities and Markets Authority (ESMA) set out how BFSIs regulated within the bloc’s 27 countries should use AI in their day-to-day operations without breaking the EU’s MiFiD securities law.

While there are significant advantages of AI in banking, such as enhancing investment strategies and client services while reducing time spent on menial tasks, it also presents inherent risks that cannot be fully understood yet, the ESMA said.

“Importantly,” says ESMA, “firms’ decisions remain the responsibility of management bodies, irrespective of whether those decisions are taken by people or AI-based tools.”

The future of AI leadership

The statement doesn’t just cover instances where AI tools have been developed in-house or formally adopted by the bank itself, but also in cases where employees use third-party tools like ChatGPT or Gemini without the direct knowledge or approval from senior management.

And according to ESMA, the onus is on the C-suite to make that happen.

This sentimentality has been a big part of the US’ approach to AI safety, mandating the appointment of Chief AI Officers in federal institutions late last year. But hiring a CAIO may be harder than it sounds.

“CAIOs are a scarce and costly commodity,” said Waseem Ali, CEO of Rockborne. “We’re not seeing many on the market… but the ones we do see are working in fintechs and insurance firms.”

Advantages of AI in Banking: Transforming the Financial Sector

The integration of Artificial Intelligence (AI) in the banking sector offers significant advantages that enhance efficiency, reduce costs, and improve customer experiences. AI’s capabilities in automating routine tasks, such as data entry and document processing, lead to substantial cost savings and operational efficiency. Advanced AI algorithms excel in detecting fraudulent transactions, bolstering security measures and minimizing financial crime.

Operational Efficiency and Cost Savings

The revolutionary impact of AI in the banking sector is already a fact. Automating processes, improving the customer experience, mitigating risks, boosting efficiency, and transforming overall operations are just some of the advantages of ai in banking. AI in banking organizations can efficiently automate a wide range of routine tasks such as data entry, account reconciliation, and document processing. This automation leads to significant cost savings and greater operational efficiency, allowing banks to optimize their resources and reduce operational costs.

Enhanced Fraud Detection

AI can analyze large amounts of data to detect fraudulent transactions more efficiently than humans. Machine learning algorithms can learn from past fraud cases to identify patterns and anomalies that can be used to prevent future fraud. With the continuous monitoring capabilities of artificial intelligence in financial services, banks can respond to potential cyber threats before they affect employees, customers, or internal systems.

For example, solutions like Transmit Security’s detection and response use AI to prevent identity fraud, even after a successful phishing attack, by continuously collecting and analyzing various parameters.

Personalized Customer Experiences

AI helps banks provide personalized experiences to their customers by leveraging data analysis to understand preferences and financial behavior. This can lead to greater customer satisfaction and loyalty. Chatbots, like the AmEx chatbot on Messenger, exemplify practical AI applications in customer service, offering 24/7 assistance and personalized recommendations, significantly improving the customer experience.

Risk Management and Predictive Analysis

AI plays a crucial role in risk management within the financial sector. By performing predictive analysis, AI provides a reasonably clear picture of future market trends, helping banks prepare and make informed decisions. AI algorithms can identify patterns of behavior and predict potential risks, allowing banks to mitigate operational risks and offer safer loans.

Improvement in Fraud Detection

AI can analyze large amounts of data to detect fraudulent transactions more efficiently than humans. Machine learning algorithms can learn from past fraud cases to identify patterns and anomalies that can be used to prevent future fraud. Millions of transactions occur daily, and AI helps banks identify fraudulent activities, track faults in their systems, minimize risks, and improve overall online finance security.

Personalized Customer Experiences

AI can help banks provide personalized experiences to their customers. With the aid of data analysis, banks can understand their customers’ preferences and financial behavior to offer personalized financial solutions. This can lead to greater customer satisfaction and loyalty. In terms of customer service, chatbots are one of the best examples of practical applications of AI in banking. Once deployed, they work 24/7, allowing humans to use their time more efficiently on inquiries that require personalized attention.

Operational Efficiency

Automation of routine tasks and optimization of operations are two of the key factors in which the role of AI in banking is crucial. Automating processes leads to significant cost savings and greater operational efficiency. With AI in banking, organizations can efficiently automate a wide range of routine tasks such as data entry, account reconciliation, and document processing. It also allows the bank to speed up certain online processes by offering real-time services, since some documents are now not processed manually by humans but by AI, which improves the quality of the final service.

Risk Management

External global factors such as currency fluctuations, natural disasters, or political instability severely impact the financial sector. During these times of volatility, it is crucial to make business decisions with great caution. AI in banking is capable of performing predictive analysis that provides a reasonably clear picture of what is to come, helping the sector to be prepared and to make decisions in a timely manner. As AI is capable of analyzing large amounts of information, its algorithms can identify patterns of behavior and transpose them as risk predictors.

Risks and Challenges of AI in Banking

While we have observed numerous advantages of applying AI in banking, as with any technology that advances and changes in a matter of seconds, we must not lose sight of the risks that its use implies. There are great challenges to be faced in order to use artificial intelligence in a sensible and ethical way.

Data Privacy and Security

Banks collect large amounts of data from customers, and AI algorithms require access to this data to function effectively. If sensitive data exist, as is often the case with financial data, any security breach could have serious consequences. Additionally, there is the issue of compliance with privacy regulations, such as the General Data Protection Regulation (GDPR) of the European Union. In fact, the EU has published a draft law to regulate AI, which details when artificial intelligence can and cannot be used.

Automation of the Investment Process

Some banks in the banking sector are delving deeper into the world of AI by using their smart systems to help make investment decisions and support their investment banking research. Firms like Switzerland-based UBS and Netherlands-based ING are having AI systems scour the markets for untapped investment opportunities and inform their algorithmic trading systems. While humans are still in the loop with all these investment decisions, the AI systems are uncovering additional opportunities through better modeling and discovery.

In addition, many financial services companies are offering robo-advisers to help their customers with portfolio management. Through personalization, chatbots, and customer-specific models, these robo-advisers can provide high-quality guidance on investment decisions and be available whenever the customer needs their assistance. This use of AI in the banking industry not only improves customer interactions but also reduces the risk of human error in investment decisions.

Risks and Challenges of AI in Banking

Emerging technologies are risky due to their immaturity and the limited time they have been in action. The risks of using AI are compounded by the fact that the field is evolving so quickly. In addition to the benefits of using AI in banking, companies must also consider the following risks and challenges:

AI Bias: AI bias is one of the biggest risks in using AI in banking. This is due to how decision-making AI models are developed, namely by humans who bring their biases and assumptions to the training of the machine learning model. These biases can be magnified when the model is deployed, sometimes with troubling results. AI models must be continuously updated to accommodate new factors and head off “model drift.”

Explainability and Ethics: Financial institutions operate under regulations that require them to issue explanations for their credit-issuing decisions to potential customers. This makes it difficult to implement tools built around deep learning neural networks, which operate by teasing out subtle correlations between thousands of variables that are typically incomprehensible to the human brain. Companies need to ensure their AI models are transparent and their decision-making processes are understandable.

Customer Mistrust: In addition to complying with regulations, financial services companies must be mindful of customer trust when using AI tools. Chatbots prized for their convenience will cause customers to lose trust if they make mistakes, impacting overall customer satisfaction.

Cost: The pace of AI innovation is both exciting and costly. There is often a lag between the time an algorithm is created in the lab and when it is deployed, simply because it is too expensive to run it. Even widely adopted algorithms can prove too costly to use profitably. This underscores the need for financial services companies to carefully assess.

What’s next for AI in banking?

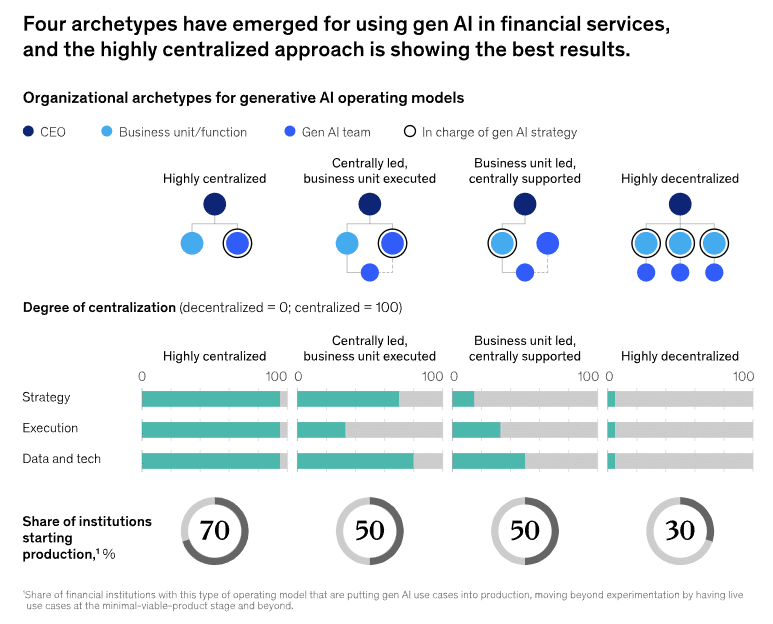

According to McKinsey, gen AI could add between $200 billion and $340 billion in value annually across the global banking sector – largely through increased productivity.

But there are risks that come with the corporate use of these tools that have been slowing the realisation of that value.

Conor Larkin, Senior Manager in Risk Analytics Recruitment at Harnham, says: ” Banks are investing heavily in AI to stay competitive, indicating strong industry commitment to technological advancement. But concerns about data privacy, potential biases in AI models, and regulatory challenges, provide some friction to the adoption of AI in this space.”

Without the right talent and strategy to correctly implement and utilise AI, the financial sector will be unable to fully reap the benefits of the technology.

For more information on risk analytics recruitment, reach out to Conor Larkin.

Take part in our 2024-25 Data & AI Salary Survey today for five chances of winning £100/€100/$100! Start HERE.